MicroStrategy’s Bitcoin Holdings Propel Stock to Record High

MicroStrategy (NASDAQ:MSTR) has closed above $500 on Black Friday, reaching a market cap of $7.33 billion, the highest point since December 2021. The company’s long-term strategy of holding Bitcoin as a hedge against inflation has proven to be a winning one, with its stock price doubling within a month at the start of the year.

Holding Bitcoin as a Winning Strategy

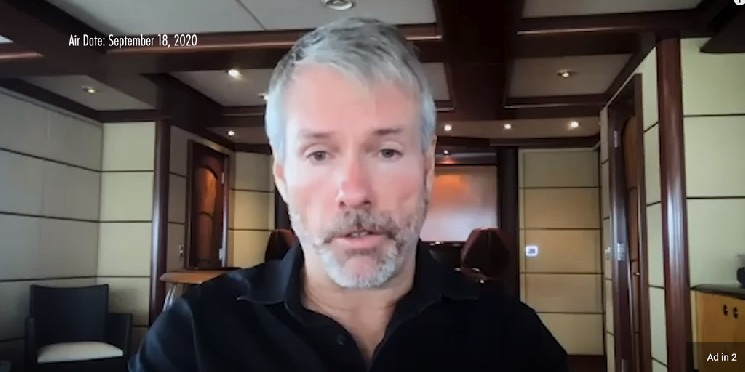

MicroStrategy’s founder and chairman, Michael Saylor, began buying Bitcoin in August 2020, and the company has emerged as one of the largest institutional holders of the cryptocurrency. “That’s why all of us are fairly bullish over the next 12 months,” Saylor told CNBC. “Demand’s going to increase, supply’s going to contract, and this is fairly unprecedented in the history of Wall Street.”

Despite initial setbacks, by April, MicroStrategy’s Bitcoin holdings were in the green, with the purchase of 1,045 additional Bitcoin, increasing its total holdings to 140,000 Bitcoin, which reduced the average purchase price to $29,803 per coin.

Continued Growth and Bitcoin Acquisitions

Despite reporting a $24 million Bitcoin impairment charge in its second-quarter earnings report, MicroStrategy remained profitable as a company and continued to increase its Bitcoin holdings, amassing 152,800 coins worth about $4.4 billion. At this point, the stock of companies with Bitcoin exposure was performing even better than the cryptocurrency itself, which had already risen by 87% that year.

Despite a net loss of $143.4 million in its most recent quarterly report, MicroStrategy continued to invest in Bitcoin, acquiring another 6,067 Bitcoin for $167 million. The company now holds approximately 0.75% of Bitcoin’s total circulating supply.

An Unprecedented Record

MicroStrategy’s strategic investment in Bitcoin has propelled its stock to new heights, closing comfortably above $500 and reaching a market cap of $7.33 billion. The company’s unwavering dedication to holding Bitcoin as a long-term asset has proven to be a successful strategy, despite initial setbacks. With the cryptocurrency market showing signs of recovery, MicroStrategy’s bullish approach to Bitcoin investment has positioned it as a leader among institutional holders of the digital asset.

I have over 10 years of experience in the field of cryptocurrency and blockchain technology. I have attended numerous conferences and events around the world, and my work has been featured in major publications such as CoinDesk, Bitcoin Magazine, and Yahoo Finance.